Executives and boards look at digital risk as a business risk.

When executives ask about digital risk protection, they are not asking how many alerts were triggered or how many domains were monitored. They want to understand exposure, impact, and control.

They want to know where risk exists outside the organization, how it could affect revenue and trust, and whether the company is reducing that risk over time.

This is why digital risk protection for boards looks very different from how security teams often frame it.

The conversation starts with money. It moves quickly to trust, operations, and competitive position. And it ends with one core question: are we in control of what’s happening outside our perimeter?

Financial Exposure is The First Concern

For boards and executive teams, digital risk protection matters financially before it matters technically.

External attacks do not stay abstract for long. They turn into direct costs that show up on financial reports, legal reviews, and board decks. When leaders evaluate digital risk protection, they are asking how it reduces those costs and how it prevents new ones from appearing.

The most common sources of financial exposure include:

- Fraud losses tied to phishing, brand impersonation, and credential abuse: This includes lookalike domains, fake support pages, and impersonated executives lead to wire fraud, account takeovers, and stolen customer payments.

- Legal and regulatory costs that follow public incidents: Investigations, compliance reviews, fines, and mandatory disclosures all require time, legal support, and budget.

- Incident response and recovery expenses: Consider emergency response teams, system resets, customer notifications, and extended monitoring after an incident.

- Lost revenue: Delayed deals, cancelled contracts, and refunds, when customers no longer trust digital channels.

- Opportunity cost: Teams are pulled away from growth initiatives to manage fallout, audits, and remediation work.

What executives quickly notice is that these costs compound. A single external incident often triggers several of them at once.

Boards also understand the difference between proactive and reactive.

Reactive means paying after exposure has already spread. Being proactive means reducing the chance that exposure turns into an incident at all.

Reputation and Trust are Inseparable From Security

For executives and boards, reputation is not a soft metric. It directly affects revenue, valuation, and long-term growth. This is why digital risk protection for boards cannot be separated from trust.

External threats often damage trust before they cause any visible technical damage.

Common trust-impacting scenarios include:

- Customers receiving phishing emails or texts that use the company’s name and branding

- Fake social media accounts posting misleading or harmful content

- Impersonated executives sharing disinformation publicly or internally

- Fraudulent job postings or support pages abusing brand identity

Even if no internal systems are breached, the damage still occurs.

From a board’s perspective, this erosion of trust creates long-term risk. Rebuilding reputation takes time, resources, and consistent effort. It often requires increased spending on marketing, communications, customer support, and legal review, all while growth stalls.

This is why executives care about visibility into how their brand and leadership are being represented outside the organization. If someone else controls the narrative, the company has already lost ground.

Operational Disruption is What Forces Executive Attention

Executives pay attention to digital risk when it interferes with how the business runs.

Many external threats do not begin as major incidents. They start as isolated issues outside the organization. But once they affect operations, leadership gets involved quickly because momentum slows and focus shifts away from growth.

Digital risk disrupts operations in several common ways.

1) downtime and containment actions interrupt normal workflows

When impersonation campaigns, phishing attacks, or leaked credentials show up, teams often need to pause systems, restrict access, or reset accounts. Even short disruptions can affect customer experience, internal productivity, and service delivery.

2) Teams move into “crisis” mode

Security, IT, legal, communications, and leadership are pulled into the same issue at once. Normal priorities are paused while everyone works to understand what happened, what is real, and what needs to be addressed immediately.

3) Product launches and campaigns get delayed or rolled back

If a new app, feature, or marketing push is tied to exposed credentials, lookalike domains, or brand misuse, leaders may decide to halt or undo it until risk is under control. That delay directly affects revenue and planning.

4) Internal confusion slows decisions

When employees see impersonated executives, misinformation campaigns, or misleading content online, uncertainty spreads. People hesitate to act, verify instructions multiple times, or stop altogether.

5) Resources are diverted from growth to damage control

Budget, time, and attention shift from expansion to investigation, remediation, and reassurance.

For boards and executives, this is the tipping point. Digital risk becomes urgent when it slows the business down. Operational disruption is not theoretical. It is visible, measurable, and costly.

Competitive Disadvantage is the Long-Term Cost

Digital risk does not just create short-term disruption. Over time, it quietly weakens a company’s competitive position.

Executives understand that markets reward confidence and stability. When an organization shows signs of external risk that it cannot fully control, competitors benefit without doing anything at all.

Here’s how the competitive damage usually shows up:

1) Customer churn after public incidents

When customers see fraud attempts, fake support pages, or misleading content tied to your brand, trust drops. Some leave right away. Others stay but reduce usage, delay renewals, or increase complaints and support pressure.

2) Deals lost due to perceived risk

Security reviews happen in almost every serious sales cycle. If a buyer sees recent brand impersonation, credential exposure, or public disruption, the deal can slow down or die. Even if the technical issue is contained, the buyer still sees uncertainty.

3) Higher cost to acquire new customers

After trust is lost, growth becomes more expensive. You spend more on marketing, incentives, and reassurance just to get back to baseline. That reduces margin and makes forecasting harder.

And while your teams are in recovery mode, competitors often move more quickly by:

- Pushing messaging around stability and trust

- Targeting the same customers with “safer” positioning

- Taking advantage of delays in your roadmap or launches

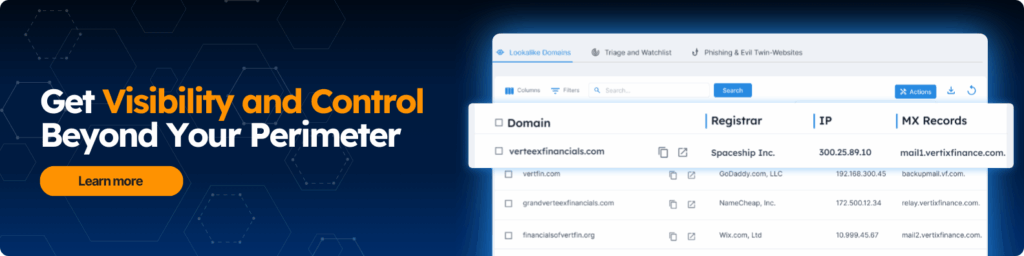

Visibility is the Non-Negotiable Requirement

When executives ask for visibility, they are not asking for more alerts or more dashboards.

They are asking a simple question: Do we know what is happening outside the organization that could affect us next?

For boards, visibility is about awareness and control, not volume.

Executives are not looking for:

- Endless alerts without context

- Technical logs that require interpretation

- Raw data with no clear relevance to business risk

Noise creates hesitation, not confidence.

So, what does visibility mean?

Visibility means having a clear picture of external risk, before it turns into an internal problem.

That includes knowing when:

- External reconnaissance is happening, such as threat actors collecting information about the organization, its people, or its vendors

- Impersonation infrastructure is being prepared, including lookalike domains, fake profiles, or fraudulent landing pages

- Credentials tied to employees or partners are exposed outside the organization

- Third-party or vendor issues increase your own risk, even if your systems are not directly breached

- Assets exist that leadership did not know about, such as forgotten domains, misconfigured services, or public-facing systems created outside formal processes

This is why boards consistently push for visibility beyond the perimeter.

Most digital risk forms externally. By the time it appears in core systems, the window to act early has already closed.

Executives know this instinctively: you cannot manage risk you cannot see.

What Executives Expect From a Modern Digital Risk Program

At the board level, digital risk protection is expected to reduce uncertainty around what is happening outside the organization and whether leadership is still in control of it.

If a program creates more questions than answers, it has failed, no matter how advanced the technology behind it is.

A modern digital risk program is judged on a few clear expectations.

1) A unified view of external risk

Executives expect to see external risk in one place, not scattered across disconnected tools and reports.

That includes visibility into:

- Brand impersonation and misuse

- Credential exposure on the dark web tied to employees, customers, or vendors

- Executive targeting and identity abuse

- Third-party and supply chain exposure

- Public-facing assets and infrastructure

Fragmented views create blind spots. A unified view creates confidence.

2) Context around why something matters

Raw findings do not help decision-making. Context does.

Executives expect every identified risk to answer basic questions:

- What is this?

- Why does it matter to the business?

- Who or what could be impacted?

- How urgent is it?

Without that context, risk becomes noise. However, with context, risk becomes actionable.

3) Prioritization based on business impact

Not all external risks deserve the same level of attention.

Boards expect prioritization that reflects:

- Likelihood of abuse

- Potential financial impact

- Brand and trust implications

- Exposure of critical systems or people

This allows leadership to focus resources on where they actually reduce risk, rather than reacting to volume.

Learn more: The Risk Scorecard Explained: The “Secret” Behind the Numbers

4) The ability to act

Visibility without action is not enough.

Executives expect digital risk programs to support real outcomes, such as:

- Disrupting impersonation efforts early

- Taking down fraudulent infrastructure

- Cutting off exposed access before it is abused

- Reducing the spread of misinformation or fraud

Observation alone does not reduce risk; you need action.

5) Continuous monitoring, not one-time assessments

Boards understand that external risk changes constantly.

They expect monitoring to be ongoing, not something reviewed once a quarter or after an incident. Digital risk protection is not a project. It is an operating function that adapts as the organization grows, partners change, and attackers shift tactics.

At its core, executives expect digital risk protection to reduce uncertainty. When leaders can clearly see what is happening, understand why it matters, and trust that action is being taken, decision-making becomes faster and more confident.

How Executives Think About Metrics and Reporting

When executives look at digital risk reporting, they are not counting alerts, domains, or findings. They are looking for signs of control, improvement, and direction.

The metrics that matter most are simple and outcome-focused.

Executives want to see:

- Risk identified versus risk resolved: What exposure exists, and how much of it has been addressed. Progress matters more than volume.

- Time to detect and time to remediate: How quickly the organization sees external risk and how fast it acts once something is confirmed.

- Trend direction over time: Whether exposure is increasing, decreasing, or staying flat. Boards care about movement, not snapshots.

- Brand and reputation signals: Changes in impersonation activity, misinformation, or external sentiment that could affect trust.

- External exposure changes: New assets, third-party exposure, or credential leaks that alter the organization’s risk profile.

At the board level, metrics exist to answer one question: Are we getting safer over time?

A practical Model that Executives Understand

Executives need a process that mirrors how they already think about risk and decisions.

A modern digital risk program follows a simple flow:

- Identify: Know every external asset, attack surface, and third-party connection tied to the organization.

- Analyze: Understand where exposure exists, how it could be misused, and why it matters.

- Monitor: Maintain continuous visibility across surface, deep, and dark web.

- Prioritize: Focus first on what creates significant financial, operational, or trust risk.

- Remediate: Reduce exposure by taking down or disrupting threats before they escalate.

- Report: Communicate risk and progress clearly to executives and boards.

This model works because it aligns with how leaders assess risk: see it, understand it, act on it, and track progress.

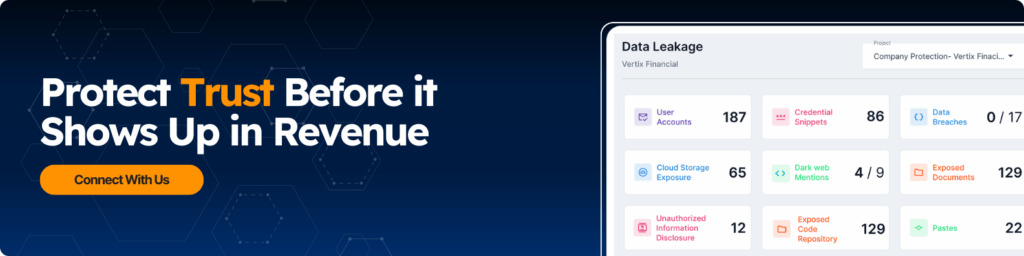

Connect with our team and see how a single, unified platform brings together:

- Brand protection

- Social media monitoring

- Executive impersonation protection

- Dark web monitoring

- Third-party risk management

- External attack surface monitoring

So teams can identify, prioritize, and reduce digital risk before it impacts the business.