About the Customer

The client is a leading multinational financial services enterprise with a diverse portfolio spanning retail banking, wealth management, and corporate finance. Operating across 20+ countries and serving over 30 million customers, the institution has built its reputation on trust, innovation, and digital-first banking solutions.

With a rapidly expanding digital footprint — including mobile banking apps, partner integrations, and online investment platforms — the client sought a robust digital risk protection strategy to safeguard its brand, data, and customer confidence in an increasingly complex threat landscape.

STYX’s Approach

Through our Digital Risk Protection (DRP) and Threat Intelligence platform, we implemented:

- Continuous dark web and deep web surveillance for financial data leaks

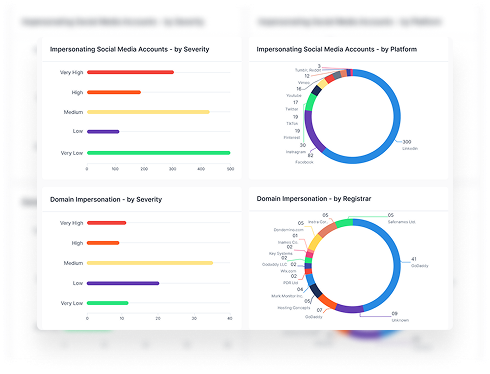

- Real-time detection and takedown of phishing domains and impersonation accounts

- AI-driven brand monitoring to track misuse across marketplaces and social channels

- Automated alerts integrated into the client’s SOC workflow

Challenges Identified

- Multiple phishing domains mimicking the brand’s official portal

- Leaked employee and customer data on underground forums

- Unauthorized apps using the company’s logo and name

- High regulatory risk due to potential financial data exposure

Conclusion

Through the implementation of advanced Digital Risk Protection (DRP) solutions, the client successfully strengthened its cyber resilience and brand integrity across all digital channels. Continuous monitoring, automated threat detection, and real-time incident response reduced exposure to phishing, data leaks, and impersonation attempts by over 70%.

This proactive approach not only safeguarded customer trust but also positioned the organization as a leader in secure digital banking — setting new benchmarks for how financial institutions can thrive in an evolving risk environment.