Mergers and Acquisitions Risk Assessment

Organizations can inherit cyber risk from partnered entities. Perform due diligence with StyxView to assess your target companies’ cyber hygiene.

Measure and Monitor Your Acquisitions When Researching Opportunities

The investigation stage of target companies can be comprehensive in addressing financial and legal risks. However, there aren’t many tools that properly evaluate cyber threats despite their frequent spillover to other functional areas.

Streamline M&A risk assessment with StyxView before your target company passes on their vulnerabilities to you. You can create risk profiles to understand their current security practices. Catch red flags and save time and money.

“Acquisitions fail to create value for Shareholders between 70-90% of the time.”

Process We Follow during M&A Risk Assessment Service

Identify Risk

Develop Assessment Criteria

Assess Risk

Assess Risk Interactions

Prioritize Risk

Respond to Risk

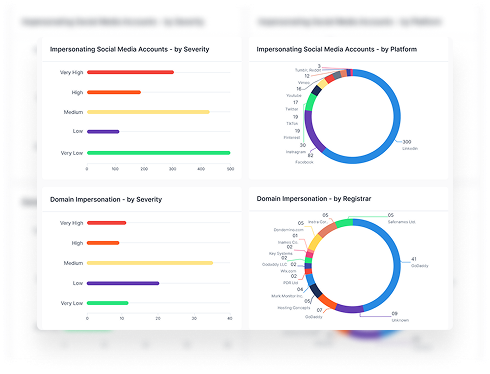

Identify Target Companies' Misconfigured Assets

It is crucial to identify and address attack surface vulnerabilities of target companies and partners that can pose a risk to your organization. StyxView’s attacker-perspective approach helps to uncover exposed assets and sources that require protection. By being able to uncover a range of asset classifications, StyxView offers insights and recommendations to ensure that target companies’ security protocols do not negatively affect your organization before making a deal.

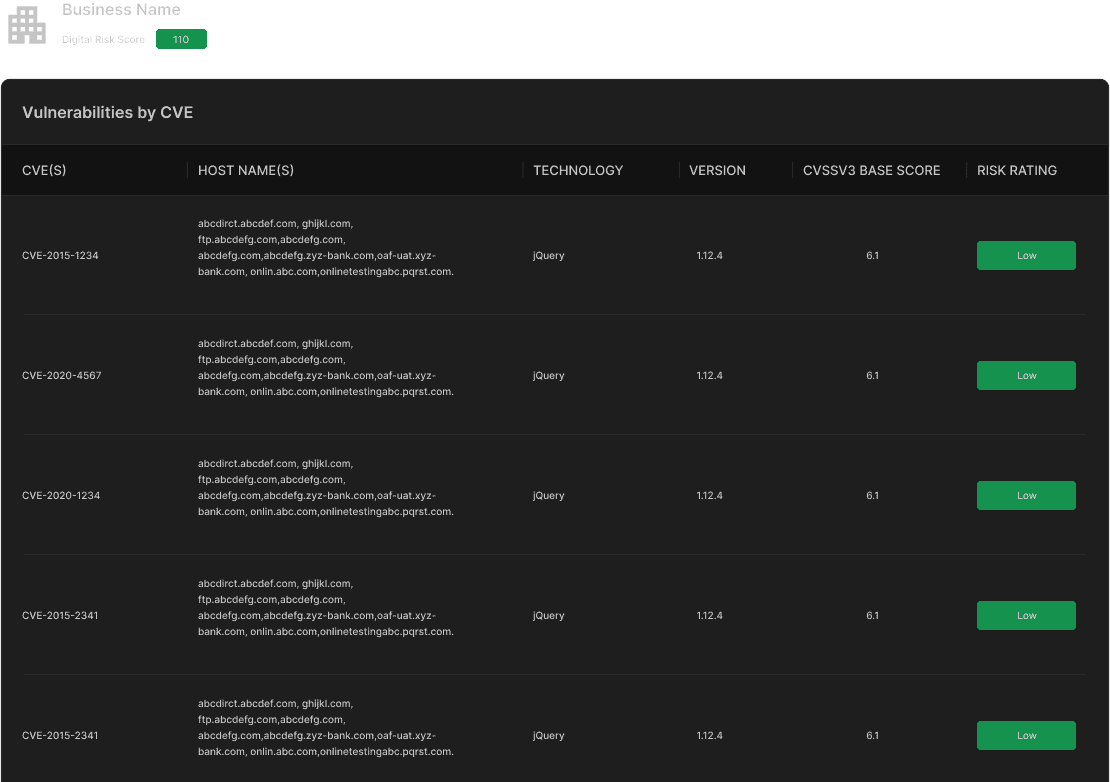

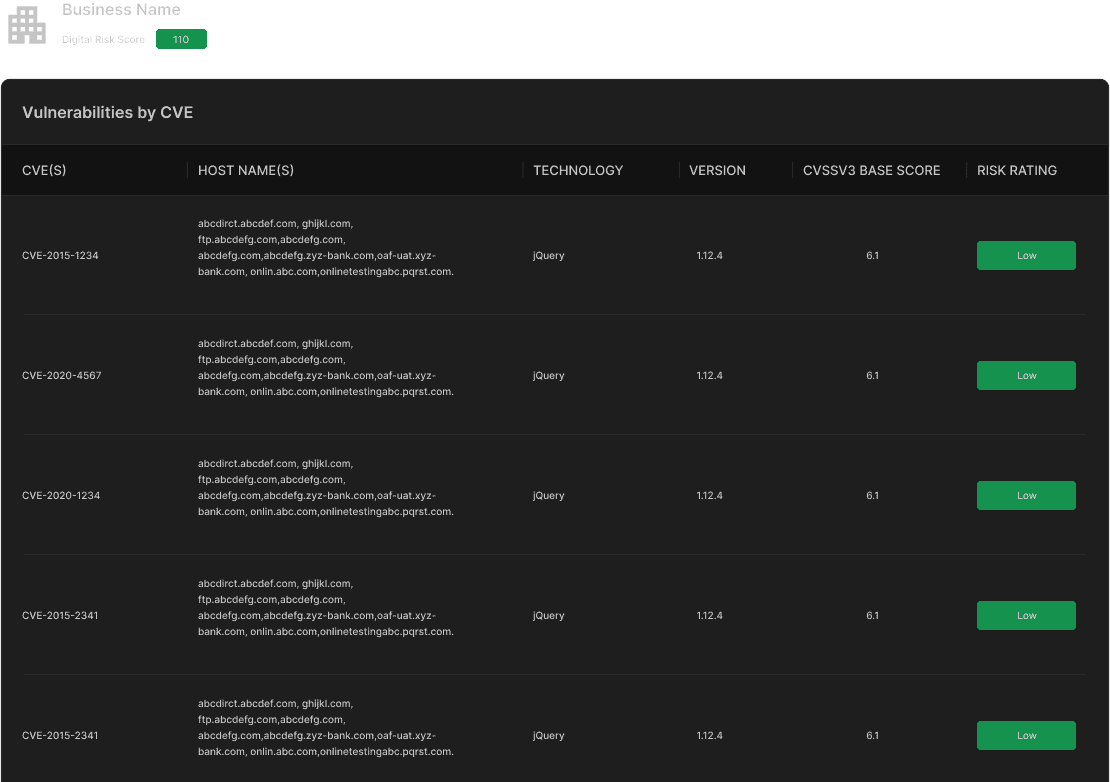

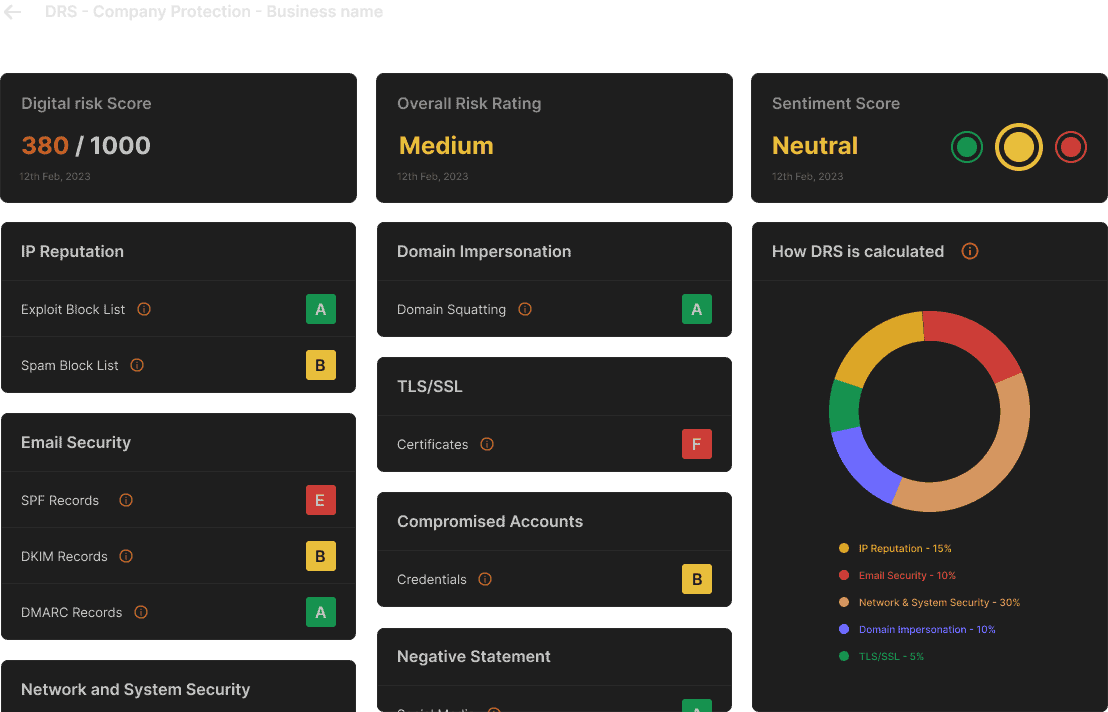

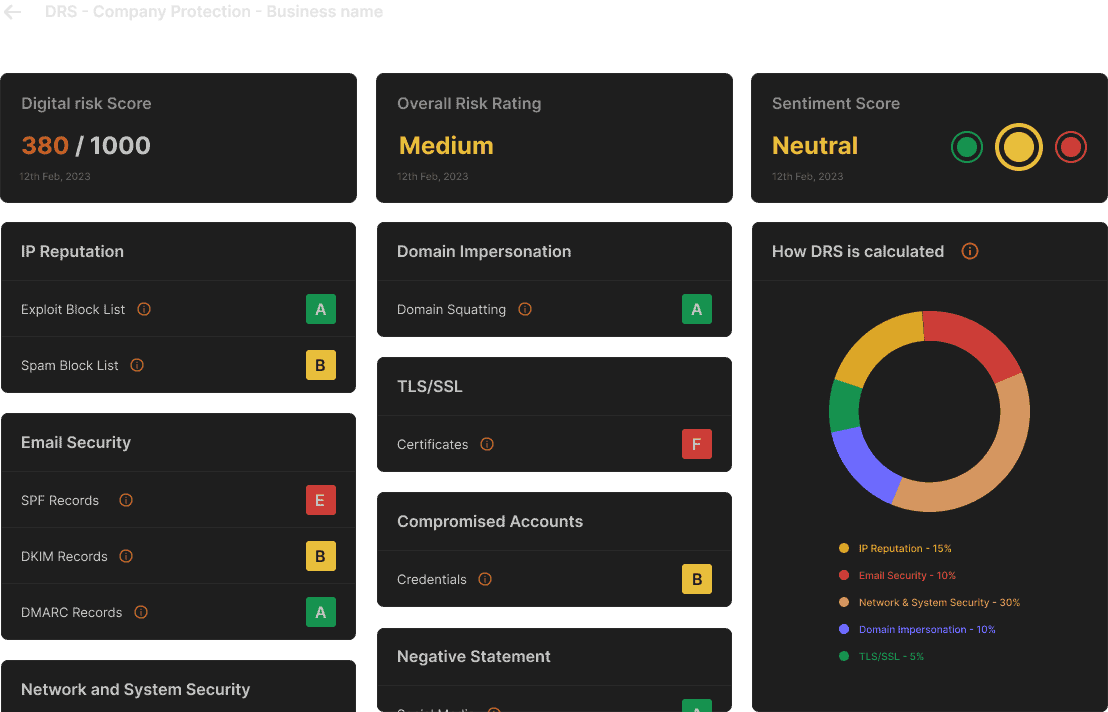

Digital Risk Score

Assess targets with StyxView’s risk-driven scoring system. The digital risk score considers various threat vectors such as breach history, brand reputation, and overall updated asset configuration to give fully illustrate each firm’s risk level. Catch commonly overlooked details before finalizing a deal and secure your business operations by prioritizing risk management efforts by all stakeholders.

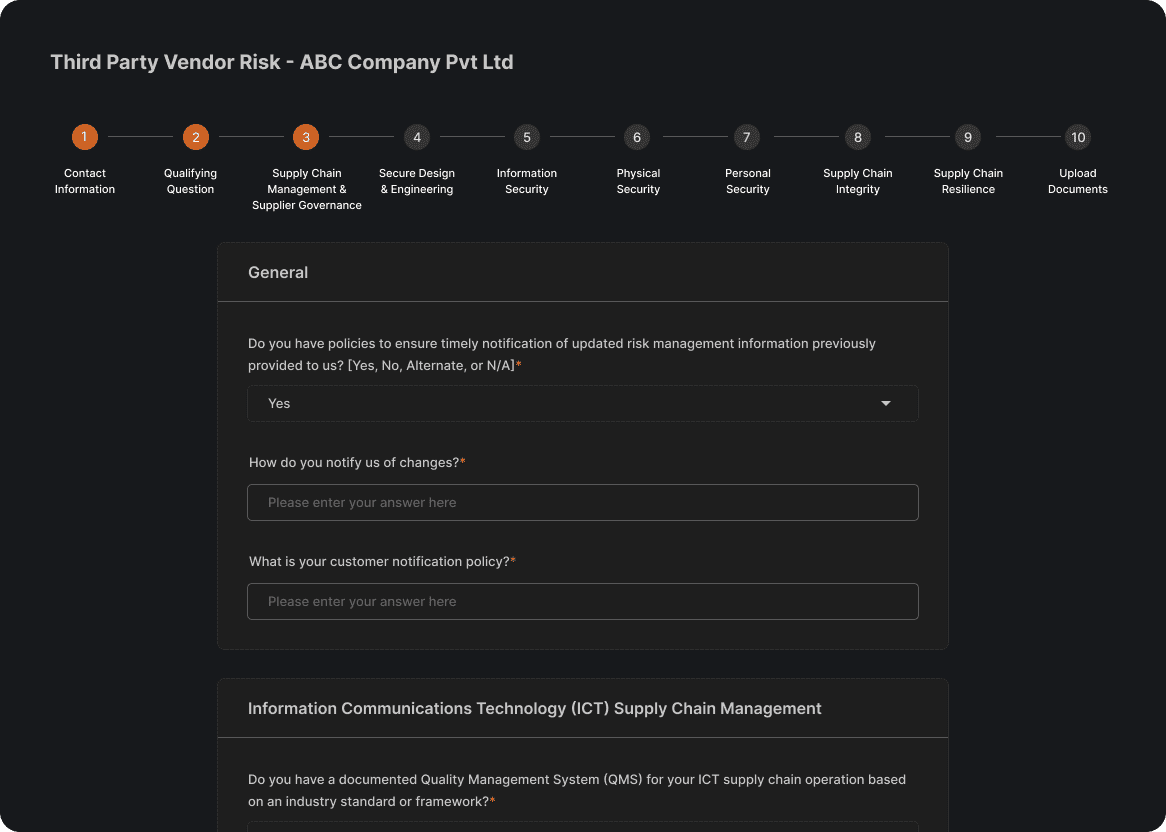

Streamlined Investigation through Automated Questionnaires

Ease your M&A due diligence with StyxView’s security questionnaire. Our platform simplifies this process by allowing target firms to provide information about their security infrastructure. This helps you obtain a comprehensive understanding of the firm’s digital risk profile and prioritize your risk management efforts, ensuring a smooth and secure transition in your M&A timeline.